1. Relatively Quick Meeting

Last night was a pretty efficient meeting by the standards of this council. They were able to get through 11 motion responses, 14 new motions, an informational report and 4 votes (bundled) in under an hour and 45 minutes.

This past weekend, Richard Howe commended Councilor Rourke on his recognition that the volume of motions filed this term has been, arguably, excessive. As a consequence, the city administration can get bogged down in drafting motion responses and the meetings can last forever.

Councilor Yem touched on the cramped nature of these meetings with this motion:

C. Yem – Req. Rules SC Set A Half Hour Rule To Read New Motions At Each City Council Meeting.

Councilor Yem indicated that the basis for the motion was last week’s meeting where Mayor Chau “rushed” through 20 motions in seven minutes. I’m not clear whether Councilor Yem is looking to set a 30 minute cap, or a minimum allotment of time. Both proposals seem unworkable. I think the Council and public at-large would be better served if councilors, such as Councilor Yem, focused on their own efficiency at each meeting. Perhaps limiting personal anecdotes, and other non-sequiturs would move these meetings along a bit quicker.

2. Retail Cannabis Revenue

Councilor Nuon filed a motion seeking an update on funding received from the excise tax on retail cannabis sales in the city.

C. Nuon – Req. City Mgr. Have The CFO Report The Balance Of The Funding In The Reserve Account From Revenue Derived From Excise On Marijuana Retail, Dedicated To The Municipal Infrastructure.

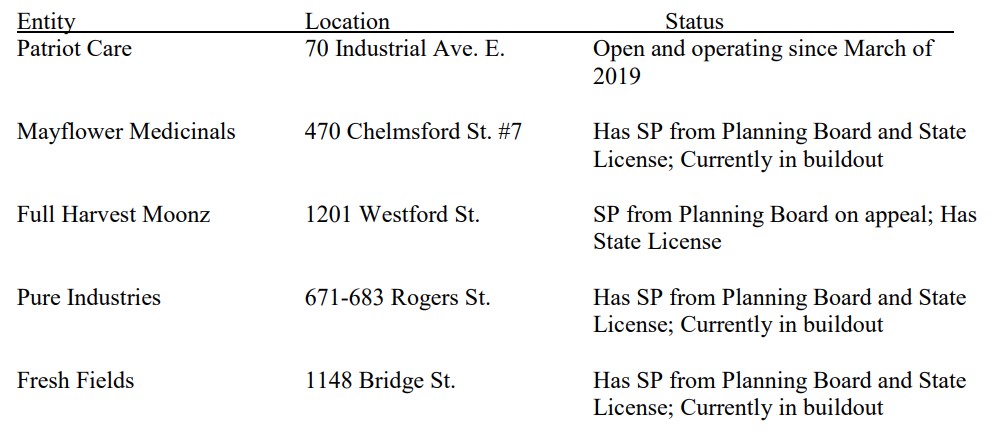

This generated a discussion on the status of our “Host Community Agreements” with our retail cannabis businesses. In 2016, Massachusetts passed a ballot question making recreational marijuana legal in the state. In May of 2018, the Lowell City Council adopted a zoning plan that laid out specific districts in the City that would allow for retail marijuana establishments. Additionally, the Council adopted an ordinance that limited the number of retail establishments to five (5).

A host community agreement is a contract negotiated between the city and the cannabis business that includes all terms necessary for the establishment to operate. The City currently has five such agreements in place:

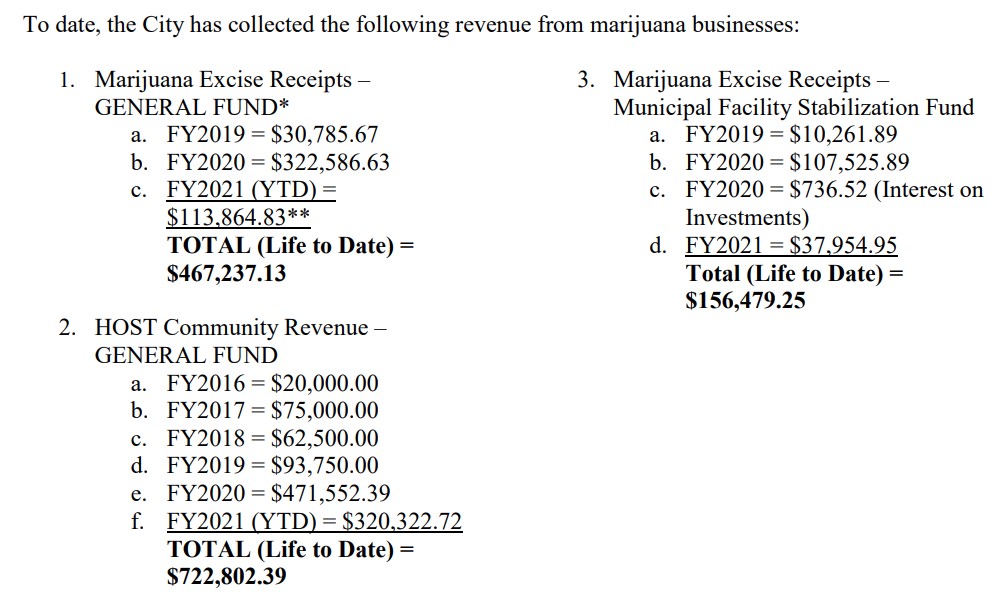

This City receives income from these businesses in two ways. From a March 17, 2021 Motion Response:

The first source of revenue authorized under the statute is a 3% local tax on all recreational

Emphasis added

marijuana sales. This local tax requires adoption by a vote of the City Council, which the Council

took on May 15, 2018. This local tax is unrestricted revenue deposited into the General Fund which

the City may appropriate and spend as it sees fit, as it does with any other General Fund revenue.

On January 29th, 2019, the Council voted to dedicate 25% of this local tax revenue to repair and

maintain municipal buildings. The legislation does not contain a sunset provision on this local tax,

so there is no end date for the collection of this revenue.

The second source is a bit more controversial:

The second source of revenue contemplated in the regulations is the community impact fee which a

Emphasis added

municipality is allowed to negotiate in a Host Community Agreement (HCA) with a marijuana

business. The regulations specifically cap this fee at 3% of the gross sales of the marijuana business.

In each HCA that has been negotiated and executed by the City Manager for a recreational

marijuana business in the City, we have required the maximum community impact fee of 3%.

Unlike the local tax option described above, the community impact fee can only be used to offset

specific community impacts of a marijuana business. Those expenditures must be documented and

maintained as a public record. In the HCAs that the City has negotiated thus far, we have added a

clause which spells out a list of items that the parties agree are eligible expenses for the community

impact fees, which include, but are not limited to, the following:

A. First responder programs (including, but not limited to law enforcement, fire response,

EMS, hospitals and clinics);

B. Lowell Board of Health initiatives;

C. Drug abuse prevention/treatment/counseling/education program(s);

D. Primary and secondary drug education programs;

E. Traffic mitigation and infrastructure improvement;

F. Increased police patrols;

G. Costs associated with Secret Shopper program;

H. Drug recognition expert funding;

I. City purchase, use, and training associated with administering Narcan;

J. City planning and inspectional staff, including overhead.

At the current time, the statute and regulations limit the collection community impact fee to five

years. Thus, under the current setup, this revenue source will cease after five years.

As of March of last year, the income was as follows:

As there is a five-year limit or “sunset clause” in these deals, the City’s legal 3% shakedown will come to an end. Councilor Mercier argued that we should seek to renew these agreements before they expire. She noted:

“God knows they’re making enough [money]…I want some of it…I want it.”

This is an interesting philosophy and one reserved for only one industry. I wonder where this mindset is when we grant tax-breaks to Kronos, Markley and The Lupoli Companies?

The purpose of the 3% community impact fee is to offset the “community impacts” of these businesses. Do we have any evidence that these businesses impact the community in ways any other legal business does not? DPD head Christine McCall cited a series of “perceived” impacts, such as complaints of odors from the cultivation facilities as well as parking and other traffic issues. I doubt our average dispensary causes more odors than Burger King or more traffic issues than your average Dunkin. Moreover, I am certain that alcohol sales account for a far greater negative community impact.

The discussion last night touched on whether we should seek to renew our current agreements or increase the number of establishments. While the law is a bit unsettled in this area, it’s apparent that the City has an antiquated mindset when it comes to cannabis retail. It seems that our approach emphasizes shame and punishment. This is evidenced by our comfort in skimming off the top as well as our zoning laws that relegate these businesses to the outskirts of the city. Meanwhile, we pound our heads against the wall wondering why Downtown has empty store-fronts.

As competition for market share in this industry increases from communities like Dracut, I am hopeful that the city will seek to cultivate (see what I did there?) a more accepting approach.